The recent bout of market volatility surrounding Evergrande intensified at the end of last month after a report from Caixin Medias WeNews that the CBIRC is examining more than 100 billion yuan of. The Evergrande Group or the Evergrande Real Estate Group previously Hengda Group is Chinas second-largest property developer by sales making it the 122nd largest group in the world by revenue according to the 2021 Fortune Global 500 List.

The property services unit of Chinas top developer sank after blocks of shares were traded at a 12 per cent discount to Tuesdays level erasing some US19 billion of market value.

Evergrande china stock market. Primary Market Maker PMM. HONG KONG Reuters - China Evergrande Group said on Tuesday its interest-bearing indebtedness has dropped to around 570 billion yuan 8823 billion from 7165 billion yuan at. Billionaire Zhang Jindongs 30-year old empire is facing a critical test as concern mounts over Suning Appliance Group Cos financial health and its links to China Evergrande Group.

HONG KONG Reuters -Chinas most indebted property developer said it had arranged its own funds of HK136 billion 175 billion to repay bonds due on Monday as well as to pay interest on all. Resurgent concerns about the health of China Evergrande Group Mr Huis flagship property company have pushed its stock to within a hairs breadth of the lowest level since March 2020. There are 3 types of market makers in the stock options market.

Chinas Evergrande says it is arranging payment for unpaid commercial paper. And - Market maker providing continuous quotes CQMM. HONG KONG Reuters -Chinas most indebted property developer said it had arranged its own funds of HK136 billion 175 billion to repay bonds due on Monday as well as to pay interest on all.

The stock has lost 21 so far this year. Zhang Yujun was put under investigation and removed as assistant chairman of the stock market watchdog in 2015 Sep 14 2021 1813 PM Former China. Shares in Evergrande dropped over 5 to HK1082 - their lowest level since March last year - before closing up 32 on Monday.

The mid price on the companys 134 billion June 2023 bond was last quoted at 80625 cents according to Refinitiv down from. HONG KONG -- China Evergrande Group the worlds most indebted property developer has arranged to use 175 billion of its own funds to redeem offshore bonds maturing on Monday and to meet. Best not to bet against passive fund flows.

And Meituan are also among the largest holdings of the benchmark MSCI Emerging Markets Index. Evergrandes bonds have also tumbled. Evergrande Property Services Group slumped in Hong Kong by the most since its December listing after an unidentified seller offloaded several blocks of shares as soon as a six-month lock-up period on key investors expired on Wednesday.

The stock has lost 21 so far this year. It is based in southern Chinas Guangdong Province and sells apartments mostly to upper and middle-income dwellers. And - Market maker responding to quote request QRMM.

China Evergrande which currently holds 6764 of Evergrande Vehicle has agreed to sell the shares at HK4092 each representing a 20 discount to Wednesdays close of HK5115 each with. Resurgent concerns about the health of China Evergrande Group Huis flagship property company have pushed its stock to within a hairs breadth of the lowest level since March 2020. Minsheng one of the major lenders to Evergrande made the comment on Wednesday evening in replies to investor questions on Shanghai Stock Exchanges E Interaction platform.

Evergrandes bonds have. The stock sank 13 per cent to HK978 at the close of trading on Wednesday erasing the equivalent of US19 billion from its market value. China Evergrandes top creditor has trimmed its loans to the nations most-indebted developer to assuage investors a sign lenders have started to raise their guard against default risks.

For the lists of PMM CQMM and QRMM please refer to the tables below. Chinas other tech giants such as Tencent Holdings Ltd. - China Evergrande announced on June 7 that it bought back 291 million shares worth a total of HK336 million 43 million according to a Hong Kong Stock Exchange filing.

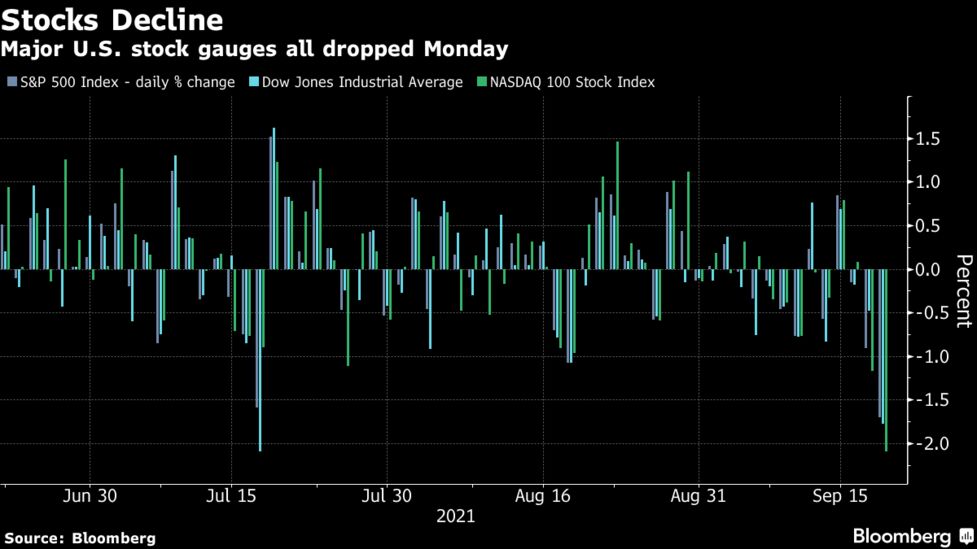

Asia Stocks Mainland China Markets Resume Trading Evergrande Crisis

Evergrande Global Growth Worries Dampen Stocks Reuters

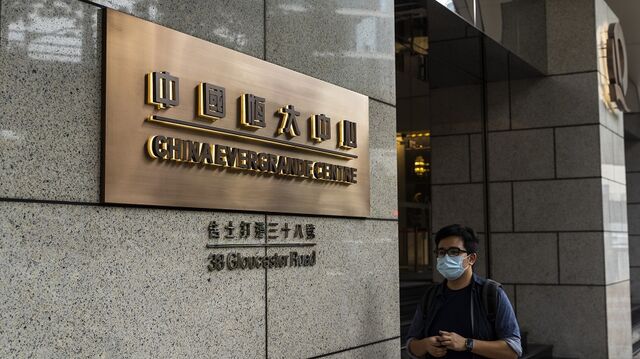

China S Nightmare Evergrande Scenario Is An Uncontrolled Crash Bloomberg